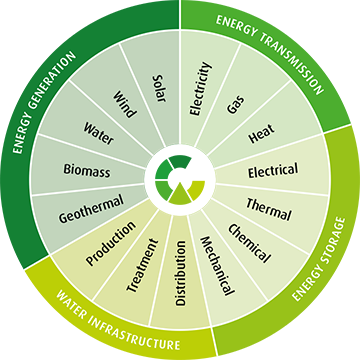

Advace Group is one of the leading independent internationally active investment specialists and asset managers in the Green Sustainable Infrastructure Investment asset class.

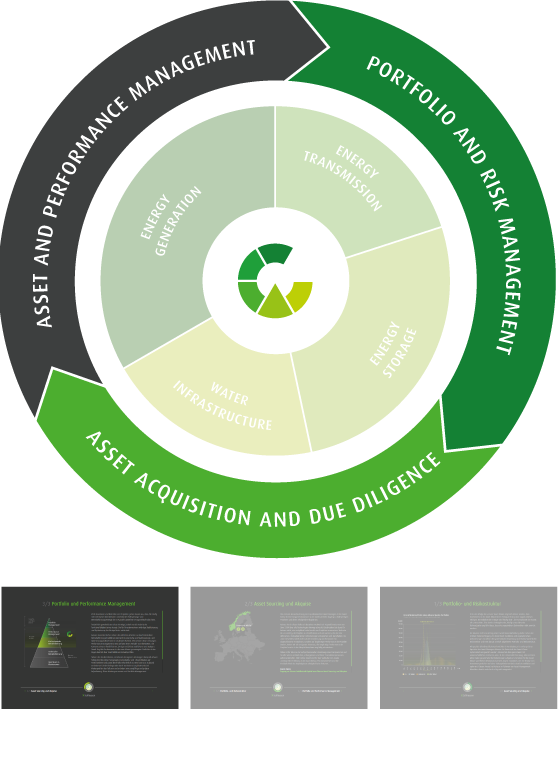

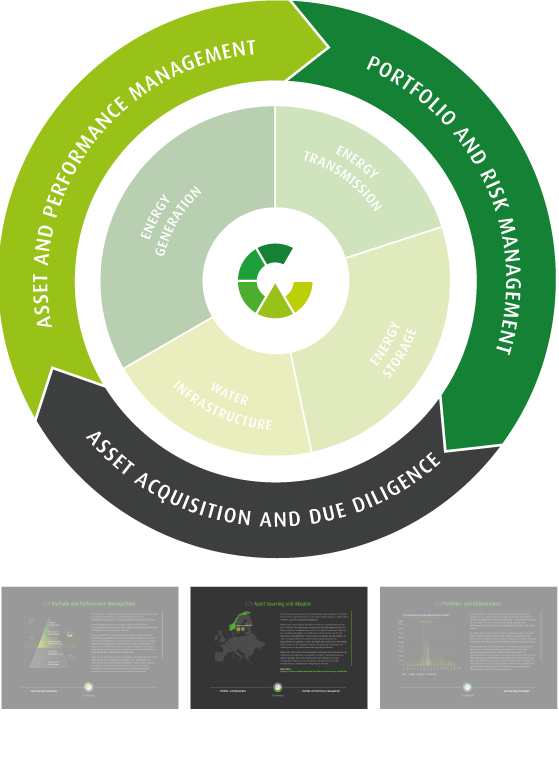

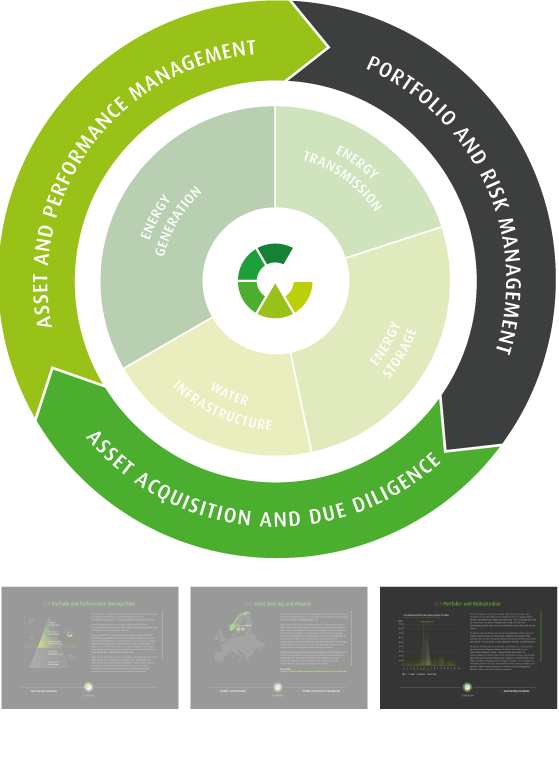

As an owner-managed company, Advace advises institutional investors and investment management companies only. Advace has been awarded various investment mandates, performing portfolio and risk structuring, asset sourcing, transaction advisory as well as ongoing dynamic asset and risk management across the investment life cycle.

Advace has been awarded asset management mandates, representing about one billion Euro investment volume.